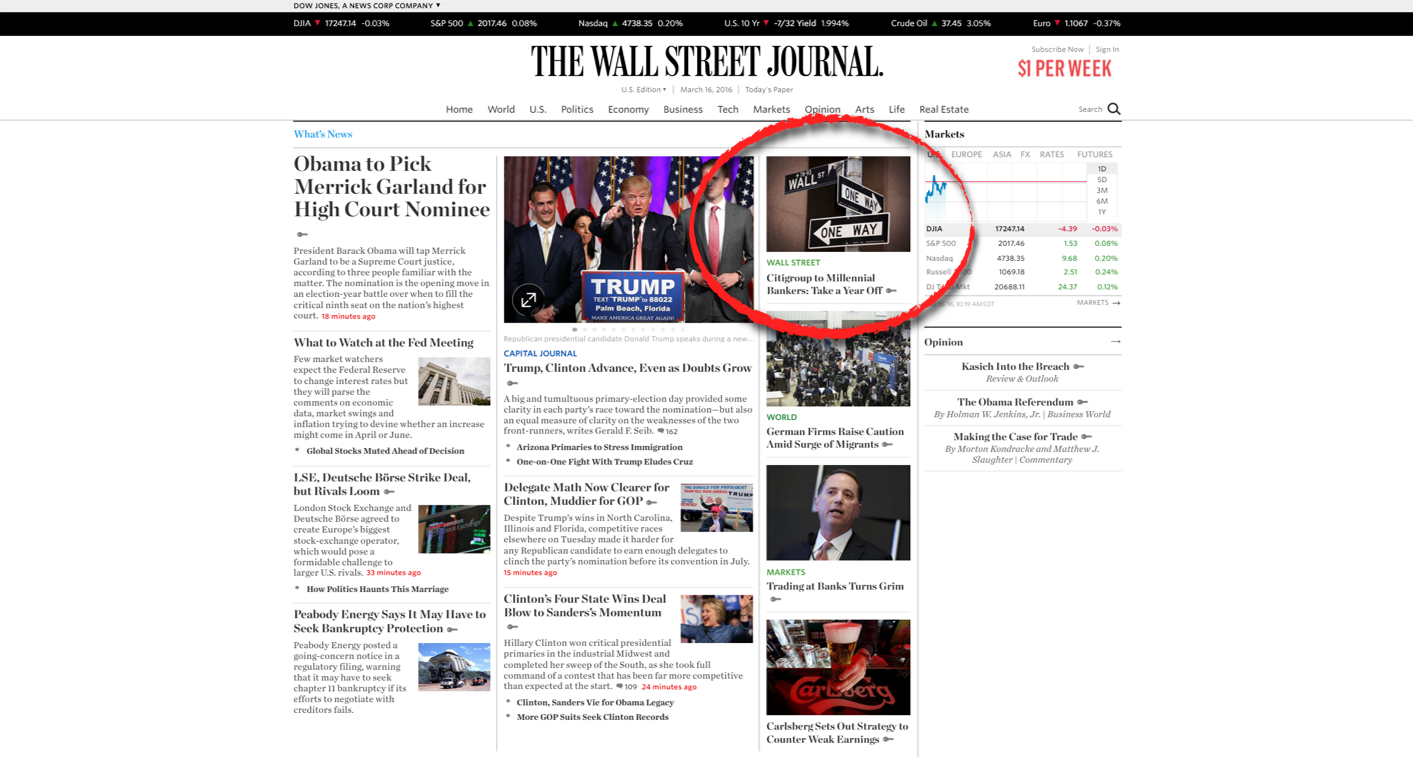

Wall Street Journal, March 16, 2016

On March 16, 2016, ServiceCorps was featured in an article that appeared on the front-page of the Wall Street Journal online. The article appeared in print on the front-page of the Markets section the following day. In less than 48-hours the article was shared on Facebook over 10,000 times.

2016

To Entice Millennial Bankers, Citigroup Serves Up New Perk: Take a Year Off

by Christina Rexrode

March 16, 2016

Banks rethink the junior-banker experience, which for years has been viewed as the dues-paying means to Wall Street riches

YOUNG MONEY

- Bank of America: Chief Resource Officers make sure junior bankers have access to a variety of projects and deals.

- Citigroup: Incoming analysts can apply to spend a gap year working at a nonprofit.

- Goldman Sachs: Analysts can compete on pitching projects to win donations for their favorite charity.

- ING: A four-year leadership program includes a capstone trip to Portugal.

- J.P. Morgan Chase: A new program, “Pencils Down,” encourages bankers to take weekends off, barring live deals.

- Moelis: Employees can get a four-week paid sabbatical after five years.

Attitudes toward young bankers have shifted so strongly on Wall Street that Citigroup Inc. has a new plan to keep them happy: Give them a year off.

The bank on Wednesday plans to unveil new programs meant to appeal to younger workers, including faster paths to promotion and the chance to take a year off to do charitable work. Citigroup is also introducing a program that lets young employees work on a four-week microfinance project in Kenya.

It’s all meant to recruit—and keep—young talent increasingly skeptical of Wall Street and eager to land a job in the technology sector.

Even the language that CEOs use has become more solicitous.

“I want people to have family lives, personal lives,” said Citigroup Chief ExecutiveMichael Corbat in an interview. “When I was a junior banker, it was a rite of passage in terms of how many hours you work. And I don’t think it’s how many hours you work. It’s how productive are you and how good are you.”

Whether community service for a couple dozen employees can alter millennials’ perception of Wall Street remains to be seen.

“It will engage millennials,” said Stacy Stevens, president of recruiting firm Park Avenue Group. “But I still think it’s the nature of millennials to get bored and to move every two or three years.”

Nine incoming analysts have already been selected at Citigroup to spend a year with one of roughly 40 nonprofits being chosen by an organization called ServiceCorps (formerly called Service Year). During that year, they’ll be paid 60% of their normal Citigroup salary. After they’re finished, they’ll start at the bank.

“These changes are just the beginning,” said Ray McGuire, who runs Citigroup’s corporate and investment bank, in a memo to employees scheduled for Wednesday.

Banks across the industry are rethinking the junior-banker experience, which for years has been viewed as the dues-paying means to Wall Street riches.

Goldman Sachs Group Inc. announced in November that it would make changes to appeal to entry-level bankers, so they can spend less time on the rote tasks of preparing “pitch books” and reformatting spreadsheets.

J.P. Morgan Chase & Co., the nation’s largest bank, recently rolled out a program that lets younger workers spend about 15% of their time helping nonprofits with technology problems, while Bank of America Corp. recently gave junior employees a path to faster promotions.

Meanwhile, Citigroup wants its younger employees to move more easily between different cities and departments.

“If you stay quiet and only later say, ‘Boy, I would have taken that job in Asia,’ then it’s not good for the employee or the bank,” said Mr. Corbat, noting that he still regrets not taking an international assignment earlier in his career. He joined Citigroup predecessor Salomon Brothers straight from college and rotated through multiple business units, before spending time in London as an executive.

Next month, a dozen junior Citigroup employees will travel to Nakuru, Kenya, for four weeks to help micro businesses there develop growth plans. More than 80 Citigroup employees applied for the trip.

Closer to the firm’s Manhattan headquarters, the bank is adding more rungs on the career ladder and more frequent feedback for young employees.The bank will also expand its student recruiting efforts, branching out from its focus on only business majors at top, well-known schools to students studying other disciplines at a wider range of universities.

Still, the moves may not go that far in changing Wall Street, where 100-hour workweeks can be a badge of honor. Citigroup more than two years ago started telling analysts and associates that they should be out of the office from Fridays at 10 p.m. through Sundays at 10 a.m., but employees still come in for critical situations.

“People continue to work outrageous hours,” said Ms. Stevens, the executive recruiter. “There’s still an element of paying your dues, and getting in from the ground floor up.”

Also, while the programs will appeal to some employees, they won’t stop someone eager to try out a faster-growing technology startup.

“There’s this thrill and excitement and risk-taking attraction,” which is pulling young bankers to technology companies, said Neil Sims, a managing partner for executive-search firm Boyden. There’s little they can do to hold those people…if Silicon Valley comes courting.”

Write to Christina Rexrode at christina.rexrode@wsj.com

Copyright ©2016 Dow Jones & Company, Inc.. All Rights Reserved.